Market Trends in Kansas City - The Q2, 2024 View

The real estate market in the second quarter has shown signs of relative robustness and stability. But... it ain't over yet! The steady number of active listings, coupled with rising numbers of pending and sold properties, indicates a vibrant market characterized by strong buyer interest and effective pricing strategies. The relatively stable number of expired listings further supports the notion of a healthy market, where properties are appropriately priced and meet buyer demand.

Market Prediction for the Rest of 2024:

Given these trends and the impending presidential election, the market is likely to see some volitility but working toward a stable and positive trajectory for the rest of 2024. Strong buyer engagement and a steady supply suggest that demand will remain relatively robust, leading to higher levels of transactions than seen in the first part of the year. The stable number of active and expired listings indicates a balanced market, capable of navigating potential volatility with confidence.

As we approach a period of political uncertainty, the real estate market's demonstrated resilience and stability offer a hopeful outlook. The market is expected to maintain its current health, though we will see some volatility as the election approaches, with steady activity and strong buyer interest across all price categories. This environment should provide confidence to both buyers and sellers, fostering a dynamic yet stable market for the remainder of the year, even amidst the inevitable challenges of a presidential election year.

Let's dig into the details...

Analyzing the trends across active, pending, expired, and sold listings from April to June provides a comprehensive overview of the real estate market, offering insights into potential future directions for the remainder of 2024.

Active Listings: The number of active listings across all price categories remains remarkably stable, indicating a balanced market with consistent supply and demand. This stability suggests that the market is neither oversaturated nor experiencing a shortage of available properties, which typically contributes to predictable and steady market conditions.

Pending Listings: The upward trend in pending listings across all price ranges signals strong buyer engagement and a robust pipeline of transactions moving towards closing. This increase in pending transactions indicates healthy market activity and suggests that many properties are being actively pursued by buyers, likely leading to higher sales in the near term.

Expired Listings: Expired listings remain relatively stable, with slight decreases in the mid-range and upper mid-range categories. This trend suggests improved market conditions, with fewer properties failing to sell within their listing periods. The stable to declining number of expired listings indicates effective pricing strategies and strong buyer interest, reducing the likelihood of properties languishing on the market.

Sold Listings: The significant increase in sold listings across all price categories reflects strong market demand and a high rate of successful transactions. The upward trend in sales is a positive indicator of market health, suggesting that properties are meeting buyer expectations and closing at a steady pace.

Overall Market Summary: Combining these trends, the real estate market from April to June shows signs of robustness and stability. The steady number of active listings, coupled with the rising number of pending and sold listings, indicates a vibrant market with strong buyer interest and effective pricing strategies. The relatively stable number of expired listings further supports the notion of a healthy market where properties are appropriately priced and meet buyer demand.

Market Prediction for the Rest of 2024: Given these trends, the market is likely to continue its stable and positive trajectory for the rest of 2024. The strong buyer engagement and steady supply suggest that demand will remain robust, leading to continued high levels of transactions. The stable number of active and expired listings indicates that the market is balanced, with no immediate signs of volatility or major shifts.

Therefore, the real estate market is expected to maintain its current health, with steady activity and strong buyer interest across all price categories. This environment should provide confidence to both buyers and sellers, fostering a dynamic yet stable market for the remainder of the year.

BREAKING IT ALL DOWN

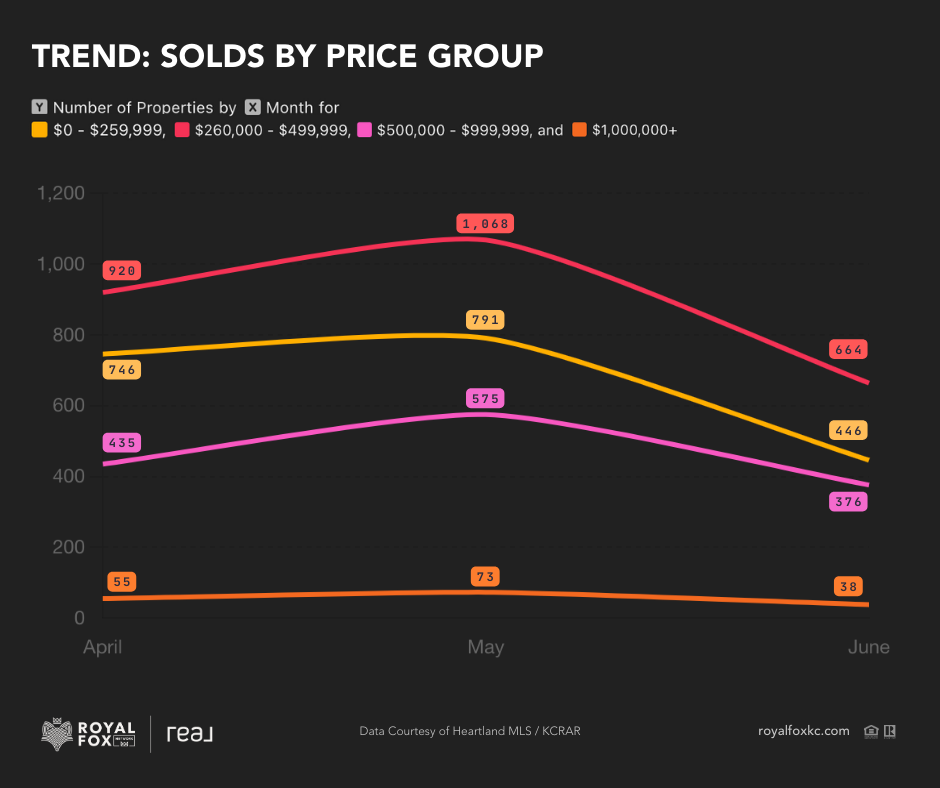

SOLD LISTINGS

Summary: Overall, our areas' sold listings point to a positive and active real estate market across all price categories. The consistent increase in sold listings suggests strong buyer demand and effective market conditions, leading to successful transactions. This upward trend in sold listings reflects a healthy and dynamic real estate environment where properties are meeting buyer expectations and closing at a steady rate. The positive trends across all price ranges indicate a confident market, with robust activity and a high rate of successful sales.

Trends amongst sold listings from April to June reveals a positive and dynamic real estate market across the various price categories.

In the $0 - $259,999 price range the trend in sold listings shows a steady increase. This upward trajectory indicates strong buyer interest and a high rate of successful transactions. The rising number of sold listings in this segment reflects robust demand, suggesting that properties in this price range are highly sought after and are moving quickly from listing to sale.

The $260,000 - $499,999 exhibits a significant rise in sold listings from April to June. This strong upward trend indicates high market activity, with many properties in this price range successfully selling. The increase in sold listings in this segment suggests a vibrant market with active buyer engagement, reflecting strong demand and effective pricing strategies.

In the $500,000 - $999,999 price range the trend in sold listings shows a noticeable increase, with some fluctuations. The overall rise in sold listings indicates a dynamic market with substantial buyer interest. Despite minor variations, the trend suggests that properties in this price range are in demand and are successfully closing, contributing to a healthy market environment.

For high-end properties ($1,000,000+), the trend in sold listings also demonstrates an increase, though more moderate compared to the lower price range. This steady rise in sold listings indicates a healthy luxury market with consistent buyer activity. The increase suggests that high-value properties are attracting buyers and closing at a stable rate, reflecting confidence in the luxury segment.

ACTIVE LISTINGS

Summary: The data indicates a steady and balanced market for active listings across all price classes, with no significant monthly variations. This trend points to a consistent real estate environment where supply and demand are in equilibrium.

Specifically:

-

$0 - $259,999: The number of active listings remains relatively steady, with a slight increase from 913 in April to 934 in June. This consistency indicates a stable demand and supply in this lower price bracket.

-

$260,000 - $499,999: Similar to the lowest price class, active listings in this mid-range category show minimal variation, hovering around 935 to 936 listings each month. This steadiness implies balanced market conditions.

-

$500,000 - $999,999: The active listings in this price range are also stable, consistently around 777 to 779 listings. The slight decrease from April to June suggests a well-balanced market with no major shifts in this segment.

- $1,000,000+: The active listings remain unchanged at 247 throughout April, May, and June. This stability suggests a consistent high-end market with no significant influx or reduction in listings.

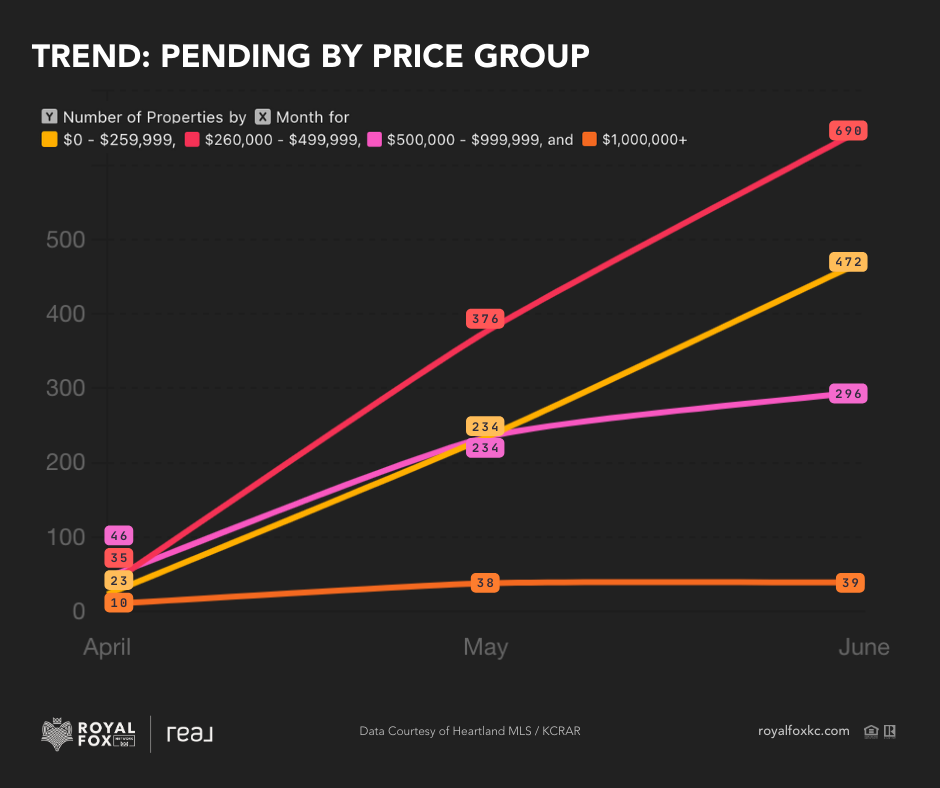

PENDING LISTINGS

Summary: Pending listings indicate a dynamic and active real estate market, with varying levels of buyer engagement across different price categories. The upward trend in pending listings across all segments points to a strong transactional activity, reflecting a market where properties are actively being pursued and are progressing towards closing. This increased activity in pending listings suggests a positive outlook for the real estate market, with robust buyer interest and a healthy pace of transactions across all price ranges.

Analyzing the trends amongst pending listings from April to June reveals some notable patterns across various price categories. Unlike active listings, the trend in pending listings shows more variation, suggesting different dynamics at play in the market.

In the $0 - $259,999 price range pending listings increased significantly from April to June. This upward trend indicates a strong buyer interest and a high rate of transactions moving toward closing in this segment. The increasing number of pending listings suggests that properties in this price range are in demand and are being actively pursued by buyers.

In the $260,000 - $499,999 price range, we've seen a noticeable rise in pending listings from April to June. This trend indicates strong market activity. The rising trend in pending listings suggests that this price range is experiencing high buyer engagement and a brisk pace of transactions.

In the $500,000 - $999,999 price range, pending listings also show an increasing trend, though with some fluctuations. The overall rise in pending listings indicates a dynamic market with active buyer interest. Despite the slight variations, the trend suggests a healthy demand for properties in this price range, with many transactions advancing towards closure.

For properties priced $1,000,000+, the trend also shows an increase, though a more moderate one compared to lower price ranges. This suggests a healthy level of activity in the luxury market, with more high-value properties progressing towards closing over the three-month period. The moderate increase in pending listings in this segment reflects a steady demand for luxury homes and a stable market environment.

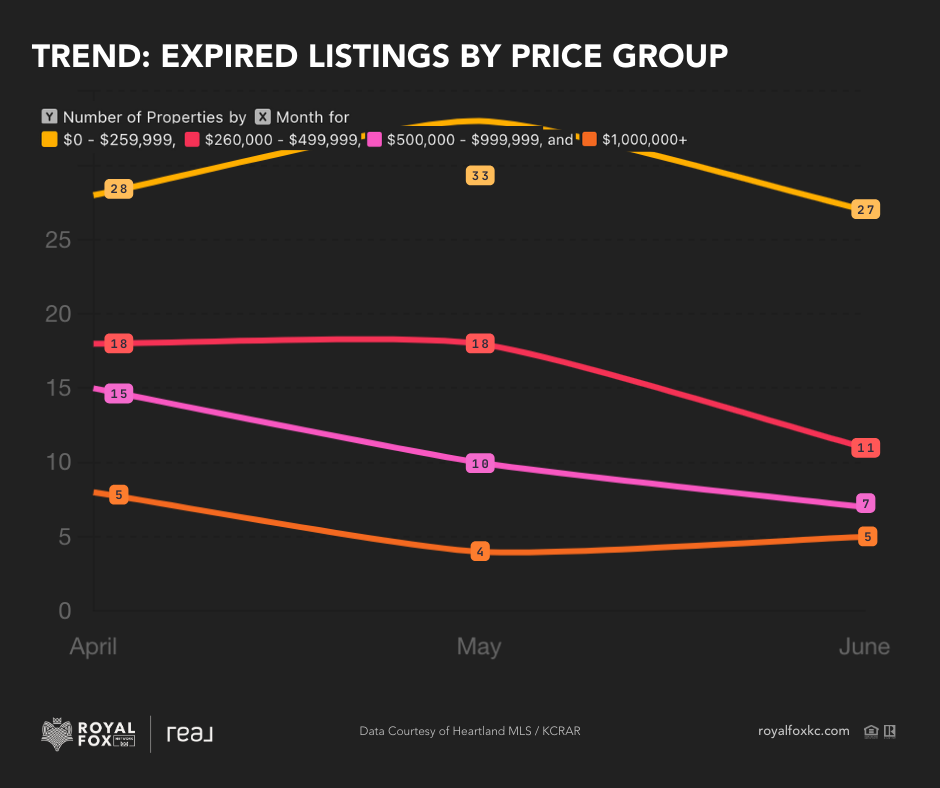

EXPIRED LISTINGS

Summary: Trends among expired listings indicates a relatively stable market with some positive signs of improvement. The stability in the lower and high-end segments suggests that properties are generally well-priced and meeting buyer demand. The declining trend in the mid-range and upper mid-range categories reflects a healthier market with effective pricing and marketing strategies leading to fewer expired listings. This trend suggests that the real estate market is becoming more efficient and balanced, with properties across all price ranges increasingly finding buyers before their listings expire.

In the $0 - $259,999 price range, the trend in expired listings remains relatively stable with only minor fluctuations. This stability indicates that the majority of properties in this price range are either selling or remaining active, with only a small number of listings expiring. The consistent level of expired listings suggests that properties in this segment are generally priced appropriately and are meeting market demand.

Properties in the $260,000 - $499,999 price range have shown a slight decline in expired listings over the three-month period. This downward trend suggests that more properties in this segment are selling before their listing contracts expire. The decline in expired listings points to an improvement in market conditions, with properties being better aligned with buyer preferences and market expectations.

In the $500,000 - $999,999 category, the trend in expired listings also shows a slight decline with some fluctuations. The decreasing trend indicates that fewer properties in this price range are failing to sell within the listing period, suggesting a healthy demand and effective pricing strategies. Despite minor variations, the overall trend implies that the market for upper mid-range properties is becoming more efficient, with fewer listings expiring.

For high-end properties ($1,000,000+), the trend in expired listings is also relatively stable but at a low level. This low and steady number of expired listings in the luxury market indicates that high-value properties, while fewer in number, are either finding buyers or are being maintained as active listings for longer periods. The low expiration rate suggests that luxury properties are either well-matched to buyer expectations or that sellers are more willing to keep these properties on the market for extended durations.

Overall Market Summary: Combining these trends, the real estate market from April to June shows signs of robustness and stability. The steady number of active listings, coupled with the rising number of pending and sold listings, indicates a vibrant market with strong buyer interest and effective pricing strategies. The relatively stable number of expired listings further supports the notion of a healthy market where properties are appropriately priced and meet buyer demand.

Market Prediction for the Rest of 2024: Given these trends and the upcoming presidential election, the market is likely to continue its stable and positive trajectory for the rest of 2024. The strong buyer engagement and steady supply suggest that demand will remain robust, leading to continued high levels of transactions. The stable number of active and expired listings indicates a balanced market, capable of navigating potential volatility with confidence.

As we approach a period of political uncertainty, the real estate market's demonstrated resilience and stability offer a hopeful outlook. The market is expected to maintain its current health, with steady activity and strong buyer interest across all price categories. This environment should provide confidence to both buyers and sellers, fostering a dynamic yet stable market for the remainder of the year, even amidst the inevitable challenges of a presidential election year.

This content is the opinion of Jana Jeffery, a residential and commercial real estate broker and managing broker of Real Broker, LLC in Kansas and Missouri and are in no way a reflection of the beliefs or opinions of Real Broker, its agents, affiliated businesses, leaders, haters, or closeted lovers or any of the authors' affiliated companies, professional partners, vendors, clients, friends, family, pets, or infestations. It's simply one woman's well-educated, independent opinion. So, don't come at me. lol ;) kthxluvubye ♥

Categories

- All Blogs 15

- 4th of July 3

- Announcements 2

- Brookside 1

- Chamber of Commerce 1

- Children's Mercy Hospital 2

- Color of the Year 1

- Community Events 6

- Consumer Confidence 2

- Consumer Sentiment 2

- Crossroads 1

- Design on a Budget 2

- Federal Reserve 1

- Fox Den Chronicles 5

- Giving Back 1

- Hearts for Healthcare Heroes 1

- Helzberg Diamonds 1

- Home Maintenance Tips 1

- Housing Policies 2

- Interest Rates 2

- Interior Design 3

- Investors 2

- Kansas City History 2

- Lenexa 1

- LGBTQ+ 1

- Local News 5

- Market Update 2

- Mental Health 2

- Mission Hills 1

- Newsletter 7

- Overland Park 1

- Pet-Lovers 2

- Prairie Village 1

- Presidential Election 2

- PRIDE 1

- River Market 1

- Roanoke 1

- Sherwin Williams 1

- Space Planning 2

- Spotlight on Home 2

- State & Local Elections 2

- Stock Market 1

- Veterans 1

- Waldo 1

- West Plaza 1

Recent Posts